IRS 8829 2025-2026 free printable template

Instructions and Help about IRS 8829

How to edit IRS 8829

How to fill out IRS 8829

Latest updates to IRS 8829

All You Need to Know About IRS 8829

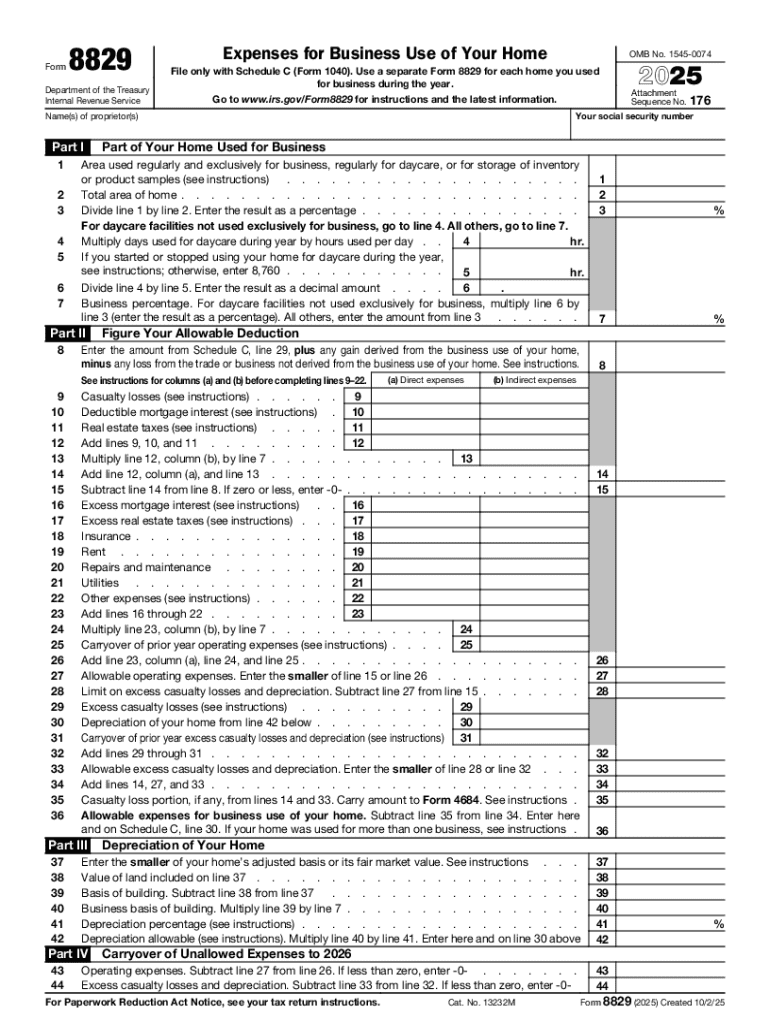

What is IRS 8829?

Who needs the form?

Components of the form

Form vs. Form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8829

What should I do if I realize that I made an error on my filed IRS 8829?

If you find an error after filing your IRS 8829, you should consider submitting an amended return. Use Form 1040X to correct any mistakes. It's important to act quickly to avoid potential penalties and ensure your tax obligations are accurate.

How can I verify the receipt of my e-filed IRS 8829?

To verify the receipt of your e-filed IRS 8829, you can check the status on the IRS website or via the e-filing software you used. Look for confirmation that your submission was accepted; if rejected, review the rejection codes for resolution steps.

Are there specific requirements regarding the retention of documents used for IRS 8829?

Yes, you should retain all records supporting your IRS 8829 claims for at least three years from the date you filed the return. This includes receipts, invoices, and documentation of expenses. Proper record retention ensures compliance in case of an audit.

What are common errors when filing the IRS 8829, and how can I avoid them?

Common errors include miscalculating the home office space or mixing personal and business expenses. To avoid these issues, always double-check your measurements and maintain clear documentation of each expense claimed on the IRS 8829.

If I receive a notice or audit regarding my IRS 8829, what steps should I take?

If you receive a notice concerning your IRS 8829, first read it carefully to understand the issue. Gather your supporting documents and consult a tax professional if needed. Respond promptly and thoroughly to the IRS request to resolve the matter.

See what our users say